Business Case Club Week #7: Benefits, Have you clearly set out the expected benefits and monetised them?

- gbp group

- Oct 30, 2024

- 5 min read

When preparing a Business Case, the preferred option should not be determined solely by cost considerations. Instead, it should be the option that offers the optimal balance of costs, risks, and benefits.

For public sector Business Cases, this determination often hinges on assessing the Benefit-Cost Ratio (BCR), a crucial metric that compares the anticipated benefits against the projected costs. In order to calculate this, you need to monetise the benefits – with some being more easily valued than others.

So, have you set out:

What benefits you expect to be delivered by the project?

What sort of benefits are you expecting?

How are you going to quantify them?

Where possible, how will you assess the monetary value of them?

Clearly identifying the benefits to be derived from any project is critical, and monetising these helps make the Value for Money argument and the case for change. Understanding and applying these principles ensures that the preferred option for your Business Case is not just the cheapest, but the one that delivers the greatest overall value, aligning with both fiscal responsibility and project objectives.

The various types of benefit classifications for a Business Case are set out below:

1. Cash Releasing Benefits (CRBs)

These are quantified in financial terms, where budgets would be reduced by the value of the benefit and/or reduce the costs for an organisation in such a way that the resources can be re-allocated elsewhere. For example, through providing a combined reception team across multiple service providers could reduce the overall number of admin team members, thereby creating a staff related cash saving.

2. Non-Cash Releasing Benefits (NCRBs)

These are quantifiable in monetary terms but no money is actually released from a budget. As a result, these can represent productivity savings whereby small elements of time are saved, which is not sufficient to make headcount savings, or re-allocate that resource to a totally different area of work. For example, by relocating services within an environment to provide adjacent services, multidisciplinary teams could reduce the time moving between locations, thereby improving efficiency. Wherever possible, consideration should be given to turning NCRBs into CRBs. For example, reducing the effort of 5 full-time members of staff by 20% each could result in the release of 1 FTE, if working practices were re-engineered.

3. Societal Benefits (SBs)

These are benefits which are quantifiable in monetary terms but the benefit is realised by society in general (ie to organisations or populations outside of the body submitting the business case ie Department for Health and Social Care (DHSC) or NHS, or Local Authority). An example of a societal benefit could be helping someone to recover from ill health and return to work earlier than without intervention, which increases economic activity but does not necessarily benefit the project owner.

4. Unmonetisable Benefits (UBs)

These are benefits which are of value to society but cannot be monetised. Where it is not possible to monetise certain costs or benefits, they should be recorded and presented as part of the appraisal. Where possible these unmonetisable values should be quantified in another way, providing an understanding of their magnitude. For example, plans to deliver a five percentage point improvement in patient experience survey scores. Given more detailed analysis some UBs can be quantified, for example, a UB relating to the reduction in patient complaints might be turned into a CRB by quantifying the reduction in litigation costs.

✏️ Top Tip: Focus on cash releasing and non cash releasing benefits and the 80:20 rule in terms of calculations: focus the most effort on quantifying and monetising the biggest benefits.

The level of detail you need to assess the project’s benefits can be dependent on the reporting requirements and stage of development of your project. The table viewable here sets out the various stages which need benefits to be included, and the level of detail and calculation required.

⭐Success Story: A new Healthy Living Centre for Kent & Medway ICB

In our work on the Healthy Living Centre project for NHS Kent and Medway Integrated Care Board, we conducted extensive analysis to identify, quantify, and monetise the benefits associated with the shortlist of options.

This effort led to a significant Benefit to Cost Ratio for the Preferred Option at the Outline Business Case stage, achieving a ratio of 9:1 compared to 6.6:1 for the next best option. As a result, a critical hurdle for approval by NHS England was successfully met.

Need help now?

Arrange a conversation with our expert Business Case Team. Contact Ian Sabini, Managing Consultant on: ian@gbpconsult.co.uk

Coming up next in our Business Case Club SERIES :

Curious to find out more or have a pressing question?

Tell us what topics you'd like explored in more detail in an upcoming webinar by filling out this brief form.

➡️ Join our members only, Business Case Club group on LinkedIn, ask the team a question or start a conversation.

Project Benefits and Business Case Stages

The level of detail you need to assess the project’s benefits can be dependent on the reporting requirements and stage of development of your project. The table below sets out the various stages which need benefits to be included, and the level of detail and calculation required.

Business Case Stage | Strategic Outline Case (SOC) | Outline Business Case (OBC) | Final Business Case (FBC) Short Form Business Case (SFBC) |

Benefits impact – Better Business Cases | Preliminary assessment of benefits in the case for change. Critical Success Factors for long listing and SWOT analysis at Short Listing via the Option Framework. | Cost benefit analysis (CBA) of shortlisted options - measure and monetise benefits. Plan for successful delivery. | Update Cost Benefit Analysis of short listed options. Ensure successful delivery by finalising arrangements. |

Strategic Case | Preliminary analysis as part of the case for change within the Strategic context. | Review and confirm SOC. | Review and confirm SOC. |

Economic Case | Determine Critical Success Factors. Long List review to include provisional value for monetary assessment(cost/benefit/ risks). Short list considers main benefits of each option to determine the Preferred Way Forward. | Economic appraisal of Short Listed Options to include cost benefit analysis. Calculation of the Net Present Social Value (NPSV) includes the measurement and monetisation of benefits. | Economic Appraisal and NPSV reviewed and updated. |

Management Case | Limited or none. | Benefits realisation arrangements should be set out at OBC, with plans for successful delivery, including: (1)Benefits Realisation Strategy. (2) Benefits Realisation Plan. (3) Benefits Register. (4) Evaluation of benefits realised. | Finalise Benefits realisation arrangements including Benefits realisation strategy, plan, register and evaluation of benefits realised. |

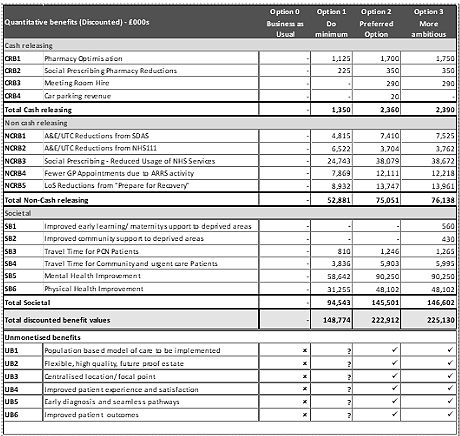

Below is an illustrative table of monetised benefits (discounted over the life of the project, i.e. 60 years) for inclusion in a business case.

Comments